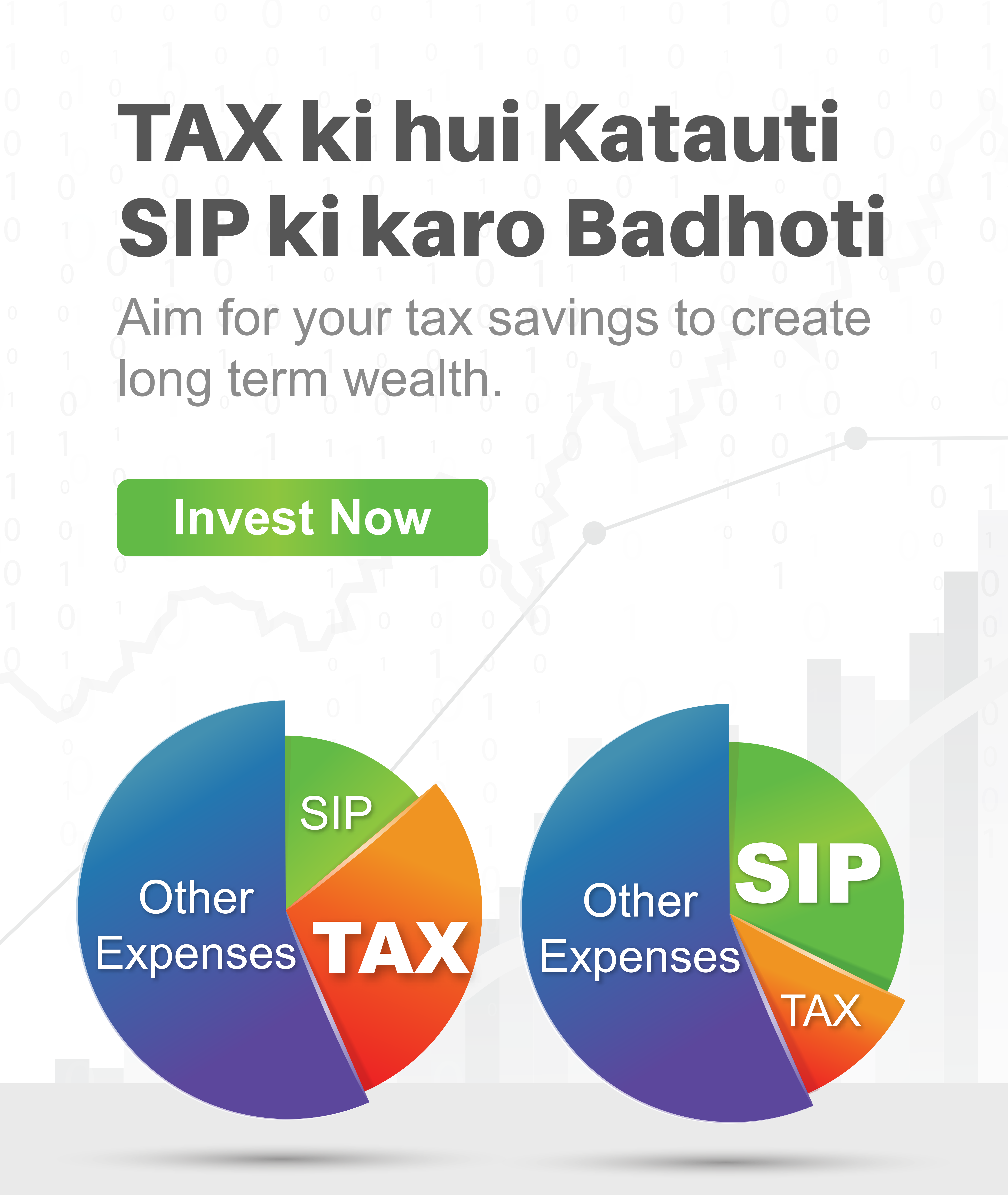

By now, you’ve probably heard about

the change in the tax rate from ‘New

Tax Regime’ announcement in this new

budget and it seems like a great news!

The saving seem substantial for

individuals due to the new Income Tax

slabs, irrespective of your tax bracket. So

consider investing the additional savings

via SIP Today!

By now, you’ve probably heard about the change in the rates under the ‘New Tax Regime’

announcement in this new budget and it seems like a great news! The saving seem

substantial for individuals due to the new Income Tax slabs, irrespective of your tax bracket.

So consider investing the additional savings via SIP Today!

Check your annual savings here

Source : Union Budget

So, what’s the plan with the

considerable extra savings? A

new phone? A bike? A vacation?

Sounds great doesn’t it!

But here’s a thought—why not

make these Extra Savings work

for you? Aim to Build wealth with

SIP Today!

So, what’s the plan with the

considerable extra savings? A

new phone? A bike? A vacation?

Sounds great doesn’t it!

But here’s a thought—why not

make these Extra Savings work

for you? Aim to Build wealth with

SIP Today!

Reasons to Invest in

Systematic Investment Plan (SIP)

Disciplined Investing

SIP is a tool that instills the habit of discipline by investing your desired amount at periodic intervals.

Rupee Cost Averaging

An investment strategy to make profits by taking advantage of the market highs and lows by buying more units at a lesser price and fewer units when the price goes higher.

Avoids Timing the Market

Time in the market is considered more important than timing the market, investing through SIPs may help you stay invested over a long term, enabling you to benefit from the market's growth potential even during periods of volatility.

Reasons to Invest in

Systematic Investment Plan (SIP)

Disciplined Investing

SIP is a tool that instills the habit of discipline by investing your desired amount at periodic intervals.

Rupee Cost Averaging

An investment strategy to make profits by taking advantage of the market highs and lows by buying more units at a lesser price and fewer units when the price goes higher.

Avoids Timing the Market

Time in the market is considered more important than timing the market, investing through SIPs may help you stay invested over a long term, enabling you to benefit from the market's growth potential even during periods of volatility.

Power of Compounding

Compounding is a long-term investment strategy where the principal earns interest, and that interest is reinvested to generate additional interest. Over time, both the principal and the accumulated interest may grow, leading to growth.

Start with small amounts

You don’t have to invest a large sum all at once but contribute small amounts at periodic intervals. Beginners can start with amounts as low as ₹ 500, which makes it simple even for students and young earners with low-paid/part-time jobs to start investing.

Power of Compounding

Compounding is a long-term investment strategy where the principal earns interest, and that interest is reinvested to generate additional interest. Over time, both the principal and the accumulated interest may grow, leading to growth.

Start with small amounts

You don’t have to invest a large sum all at once but contribute small amounts at periodic intervals. Beginners can start with amounts as low as ₹ 500, which makes it simple even for students and young earners with low-paid/part-time jobs to start investing.

Be patient. Be smart. Use this opportunity and aim to let your

savings of today turn into wealth for tomorrow.

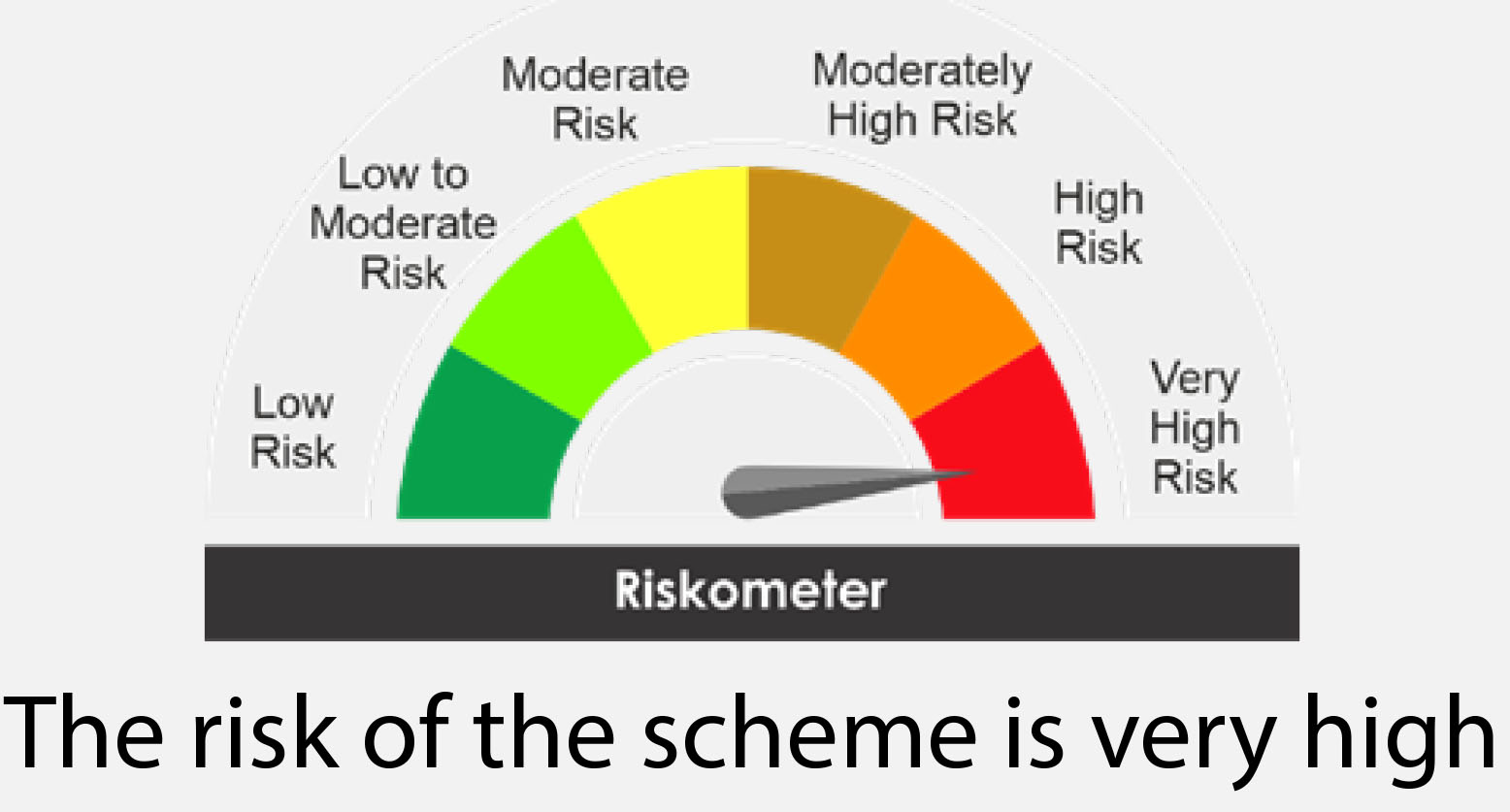

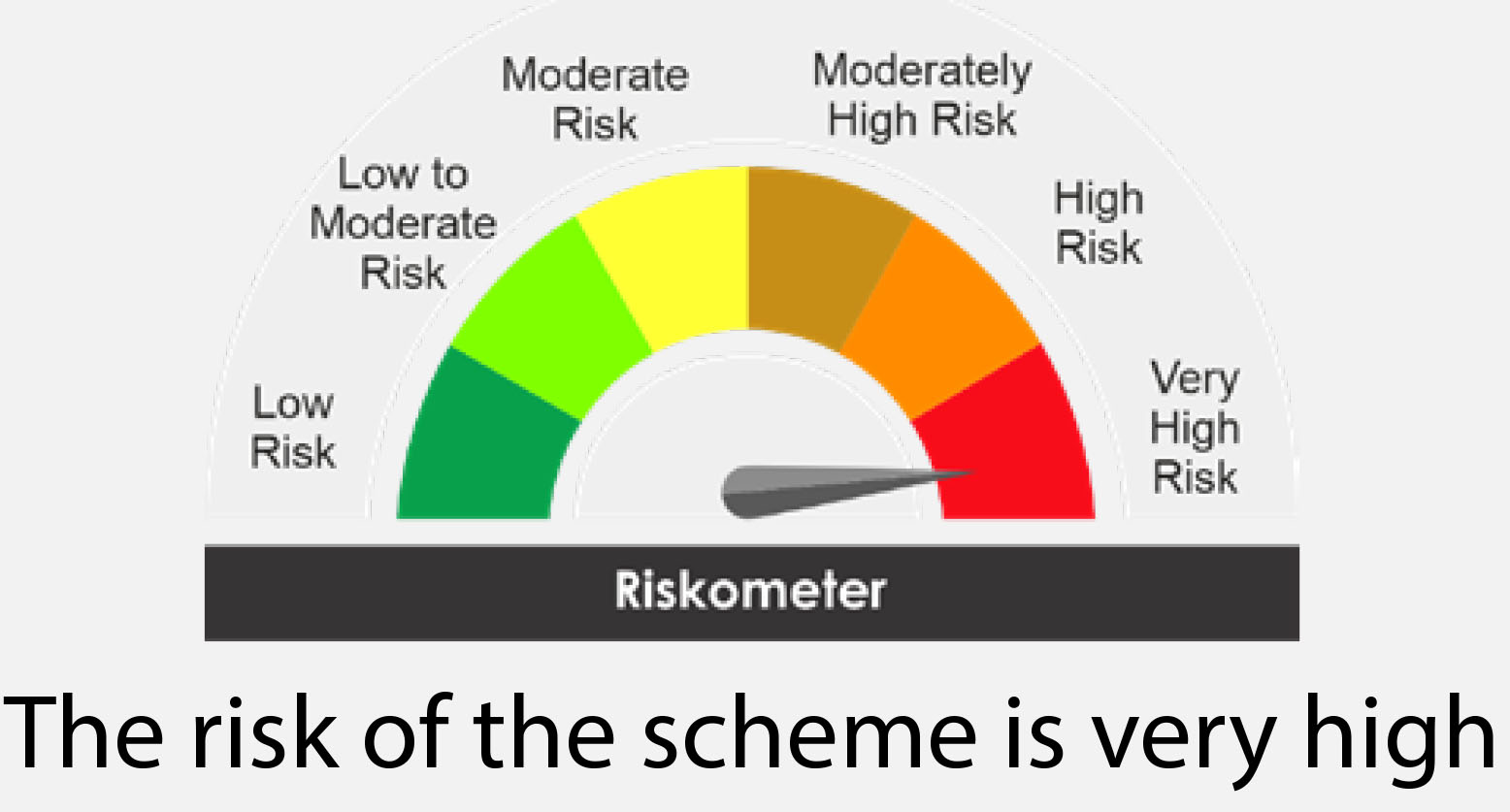

Product Label

| This Product is suitable for investors who are seeking* | |

| Scheme Name | Scheme Risk-o-meter |

JM Aggressive Hybrid Fund (An open ended hybrid scheme investing predominantly in equity and equity

related instruments).

|  Data as on April 30, 2025 |

JM Flexicap Fund (An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks)

| |

JM Midcap Fund (An open ended equity scheme predominantly investing in mid cap stocks)

| |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Product Label

| This Product is suitable for investors who are seeking* |

| Scheme Name |

JM Aggressive Hybrid Fund (An open ended hybrid scheme investing predominantly in equity and equity

related instruments).

|

JM Flexicap Fund (An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks)

|

JM Midcap Fund (An open ended equity scheme predominantly investing in mid cap stocks)

|

| Scheme Risk-o-meter |

Data as on April 30, 2025 |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer

SIP - Systematic Investment Plan. The above should not be construed as a promise on minimum returns and safeguard of capital.

The AMC / Mutual Fund is not guaranteeing or promising or forecasting any returns.

Information stated above does not construe to be any investment, legal or taxation advice. Any action taken by you based on the

information contained herein is your responsibility alone and JM Financial Asset Management Limited will not be liable in any

manner for the consequences of such action taken by you. Please consult your Mutual Fund Distributor / Financial Advisor before

investing.

For internal circulation only